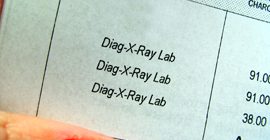

Drew Medical Center, Inc., a Florida diagnostic radiology company, agreed to pay approximately $1.5 million to resolve qui tam whistleblower claims in a qui tam suit that it systemically charged Medicare for venograms although the company was not performing those procedures.